I、Introduction

The year 2024 marked the 16th anniversary of the Anti-Monopoly Law (AML) implementation, with various antitrust initiatives advancing smoothly. It was a particularly active year for China’s antitrust legislation, featuring a series of comprehensive regulations and guidelines, alongside several significant breakthroughs, including the introduction of the world’s first Antitrust Guidelines on Standard Essential Patents.

While remaining attentive to people’s livelihoods and vital industries, the State Administration for Market Regulation (SAMR) also proactively addressed potential competition issues arising in high-tech sectors and the burgeoning areas of the digital economy and artificial intelligence (AI). This included launching an investigation into Nvidia and concluding China’s first monopoly case in the financial data sector.

1.Prioritisation and resource allocation of enforcement authorities

In 2024, the enforcement methods of China’s AML have become more diverse, efficient and innovative. In December 2023, the Office of Anti-Monopoly and Anti-Unfair Competition Commission of the State Council and the SAMR jointly launched a new ‘soft supervision’ system (a letter-and-notification system) to increase the efficiency of antitrust enforcement.[1 ]Under this system, depending on the circumstances of potential antitrust risk, the suspected antitrust violator might receive a reminder letter, a notice of regulatory interview, a notice of case filing and investigation, and an administrative penalty decision or administrative proposal from the antitrust enforcer.

展开全文

In 2024, the SAMR actively implemented this soft supervision system. Enforcement agencies across the country issued a total of 2,615 antitrust notification letters. The reminder letters and notices for regulatory interviews made up 91.2 per cent of the total.[2] Additionally, the SAMR issued reminder letters to five major automobile suppliers regarding the monopoly risks associated with unreasonable restrictions on downstream dealers, as well as the monopolistic concerns related to the Avanci patent pool in licensing standard essential patents for automobile wireless communications. This soft supervision approach demonstrates that China’s antitrust regulatory system has steadily evolved into a comprehensive regulatory model that includes both pre-regulation and post-regulation.

2.Continuous improvement of rules and regulations

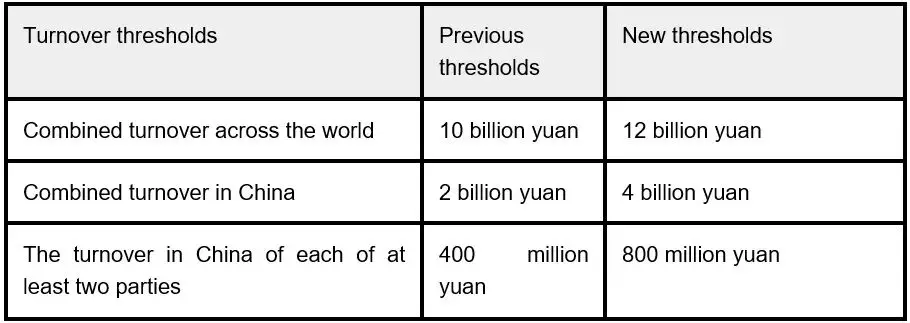

A number of antitrust rules and regulations have been refined and improved in 2024. In the area of merger reviews, the Provisions of the State Council on Thresholds for Prior Notification of Concentration of Undertakings (the new Thresholds)[3] were amended and implemented on 26 January 2024. This marks the first adjustment to the turnover thresholds for merger filings in 16 years since the introduction of the AML. Under the new Thresholds, the turnover thresholds triggering a merger filing were significantly increased. Additionally, on 14 September 2024, the SAMR updated the notification form for simple cases,[4] enhancing the filing process by streamlining the required materials and optimising the form’s logical structure. Furthermore, in December 2024, the SAMR issued the Guidelines for Review of Horizontal Concentration of Undertakings,[5] which clarify the standards and procedural guidelines for reviewing and investigating horizontal concentrations.

In 2024, China also introduced a series of antitrust guidelines focusing on specific sectors and industries. In January, the Antitrust Guidelines for Industry Associations[6] were released to delineate the lines between industry self-regulation and collaborative behaviour. In November, the Antitrust Guidelines on Standard Essential Patents[7] were published, aiming to strike a balance between intellectual property rights protection and antitrust concerns. On 25 April, the Office of Anti-Monopoly and Anti-Unfair Competition Commission released Antitrust Compliance Guidelines for Business Operators,[8] which outline the specific framework for constructing compliance systems and the criteria for evaluation. In 2024, following the Anti-Monopoly Guidelines for Active Pharmaceutical Ingredients issued in 2021, the SAMR published the consultation draft of Antitrust Guidelines for Pharmaceuticals,[9] which encompass all pharmaceutical products and the final draft was released on 26 January 2025. For the first time, the guidelines offer specific instructions regarding pay-for-delay agreements. The guidelines further clarify the criteria for identifying unfairly high prices in the pharmaceutical sector. Additionally, the guidelines provide a flexible approach regarding reasonable restrictions in joint research and development agreements in the pharmaceutical sector, especially in cases where the conduct does not significantly limit or restrict competition.

3.Introduction of antitrust compliance incentives

The Antitrust Compliance Guidelines for Business Operators, which took effect on 25 April 2024, outline the specific procedures and evaluation criteria for implementing an effective antitrust compliance system. For the first time, the guidelines introduce compliance incentives aimed at encouraging companies to achieve compliance through the development of robust systems, the use of compliance tools and participation in training and self-assessment. The guidelines specify that enforcement agencies may take into account the compliance programme implemented by an undertaking when determining penalties. A well-developed compliance programme could lead to reduced penalties during the process either in investigations, commitment agreements, leniency programmes or fines.

The compliance incentive mechanism indicates that enforcement agencies are moving from simply punishing monopolistic behaviour to actively guiding companies to contribute to a fair market order through antitrust compliance. As a result, investing in compliance can lead to quantifiable benefits, such as reduced fines. Companies need to pay close attention to issues related to antitrust compliance and develop a management system that is regularly updated to align with changes in relevant laws and enforcement practices.

II、Year in review

In 2024, antitrust enforcement continued to prioritise oversight in areas affecting people’s livelihoods. Throughout the year, the SAMR announced eight cases involving horizontal monopoly agreements across various sectors, including motor vehicle inspection, building materials, public utilities, real estate valuation and automobile sales. Seven cases of abuse of dominance were reported, including sectors in pharmaceuticals, public utilities and financial data. There were also three non-filing cases under the amended AML. Overall, in 2024, the fines imposed for all behavioural monopoly cases reached approximately 107 million yuan, marking a record low in recent years. While the total amount of fines have dropped compared to previous years, the cases in 2024 encompass a broader spectrum of industries, a diverse range of businesses and a variety of monopolistic behaviours.

The enforcement agencies also noted a decrease in the number of merger reviews, attributed to the increased turnover thresholds for declarations that took effect in January 2024. The SAMR and the five authorised local administrations for market regulation (AMR), namely, Beijing AMR, Shanghai AMR, Guangdong AMR, Chongqing AMR and Shaanxi AMR, concluded 623 merger reviews in total during 2024, significantly down from 797 reviews in 2023. Among them, only one case was conditionally approved, also the lowest number in 10 years.

III、Cartels

The SAMR and local agencies jointly concluded and published eight cartel cases during 2024. The penalty cases published covered various industries, including motor vehicle inspection, building materials, public utilities, real estate valuation and automobile sales. The total penalties imposed in 2024 amounted to 12.69 million yuan, significantly less than the 581.67 million yuan in 2023. This decrease can be attributed to both a reduction in the number of cases (three fewer than in 2023) and the fact that many of the companies involved were small and medium-sized enterprises, resulting in a limited base for fines.

1.Cartels: significant cases

(1)Xinjiang Rock Wool

On 31 March 2024, the Xinjiang AMR published a decision imposing a fine of 5.21 million yuan on five rock wool enterprises for participating in a horizontal monopoly agreement.[10]

In 2021, the five rock wool companies jointly negotiated and signed the ‘Cooperation agreement on reducing production and stabilising the market for rock wool enterprises in the Northern Xinjiang’. They agreed to limit production and set fixed prices for rock wool products in Northern Xinjiang, and implemented the agreement accordingly. The Xinjiang AMR determined that their actions violated Article 13 of the old AML, which prohibits competitors from entering into agreements that fix or alter product prices or restrict the quantity of goods sold. Each of the five companies was fined between 1 per cent and 3 per cent of their 2020 sales. One of the companies received an 80 per cent reduction in its fine since this company submitted the first application for leniency and cooperated in providing information during the investigation, and the company was penalised 0.2 per cent of its 2020 sales.

This case marks the first publicly concluded cartel investigated by the Xinjiang AMR since the implementation of the AML. It is a clear signal that AML enforcement is becoming more robust and extensive in terms of the coverage of geographic areas, which is gradually broadening its localised supervision across the country instead of being concentrated solely in the SAMR or in the AMRs of more developed regions. Additionally, the investigation of numerous cartel cases this year involving small and medium-sized enterprises with lower turnover indicates that China’s antitrust efforts are becoming more comprehensive, not only focusing on key industries and large companies, but also including all sectors and types of businesses, thereby ensuring thorough oversight and deeper regulation.

(2)Liupanshui motor vehicle inspection

In November 2024, the Guizhou AMR published a decision fining 23 motor vehicle inspection companies a total of 1.75 million yuan.[11] The Guizhou AMR discovered that from 2021 to 2024, in response to declining prices caused by oversupply of motor vehicle inspection services, the 23 companies involved in this case colluded to set uniform prices for their services under the pretence of joint operations. They appointed individuals to manage this joint effort, overseeing the promotion of their collaboration and coordinating daily operations. The Guizhou AMR concluded that the companies’ actions in fixing prices constituted a horizontal monopoly agreement in violation of Article 17 of the AML.

In this case, the joint operation, as a new type of cooperation model, was once again identified by enforcement agencies as constituting a horizontal monopoly. This assessment aligns with the key conclusions from prior typical antitrust cases issued by the Supreme People’s Court of the People’s Republic of China. This case also features the highest number of parties involved of published antitrust penalty decisions in 2024, which involved 23 companies. In recent years, the motor vehicle inspection industry has garnered significant attention from antitrust enforcement agencies and with the highest number of cartels in 2024. Among the 23 companies involved in the case, 13 were fined 2 per cent of their 2023 turnover for engaging in monopolistic behaviour and cooperating with the investigation. Seven companies faced a 4 per cent fine of their 2023 turnover for their roles in organising and promoting the infringement while also cooperating with the investigation. Additionally, two companies were fined 4 per cent of their 2023 turnover for their involvement in the monopoly but did not actively provide information about the violation. By distinguishing between organisers and participants, along with their cooperation during the investigation, the fines were calibrated accordingly, demonstrating a more nuanced approach to antitrust penalties.

2.Cartels: trends, developments and strategies

In 2024, eight cartel cases were investigated, all pertaining to livelihood sectors. In many instances, the investigative source originated from third-party complaints submitted to the regulator. Most of the companies involved in these cases were small to medium-sized enterprises, and all investigations were carried out and concluded by provincial AMRs, reflecting a trend towards regularising antitrust enforcement in China.

The regulator also investigated a case involving a horizontal monopoly agreement orchestrated by an industry association in 2024. In light of the increasing frequency of such agreements where industry associations mislead and coordinate companies to enforce monopoly practices under the guise of self-regulation and ‘group warming’, the SAMR issued the Antitrust Guidelines for Industry Associations in January 2024. The guidelines aim to help trade associations understand and fulfil their legal responsibilities while mitigating monopoly risks. Industry associations should seize this opportunity to enhance their compliance efforts and steer clear of any high-risk behaviours that could be construed as monopolistic.

3.Cartels: outlook

In 2025, cartel enforcement will continue to concentrate on critical areas such as livelihoods, the platform economy and natural monopolies. We expect that enforcement agencies will investigate the impact of new forms of cartel behaviour on competition through inter-agency collaboration, proactive interviews and other varied approaches, all while maintaining their focus on traditional cartel practices. Additionally, an increase in international antitrust enforcement exchanges is expected to encourage these agencies to pay closer attention to cartel behaviour in key areas of shared concern among global enforcement bodies.

We also foresee ongoing improvements in the discretionary benchmarks for antitrust administrative penalties. Regulators are expected to release specific guidance aimed at clarifying the percentage of penalties for operators involved in cartel cases.

IV、Antitrust: restrictive agreements and dominance

The SAMR and its local agencies concluded seven abuse of dominance cases in 2024. Of those cases, five involved public utilities, one involved the pharmaceutical industry and one involved the financial data industry. The penalties imposed totalled 88.4 million yuan. No vertical restraint cases were published in 2024.

1.Antitrust: significant cases

(1)Sumscope

The Shanghai AMR issued a penalty decision on Ningbo Sumscope Information Technology Co, Ltd (Sumscope) on 13 August 2024 for abuse of dominance.[12] The company was fined 4.53 million yuan, equivalent to 2 per cent of the company’s annual turnover in 2022.

Sumscope was the sole provider of financial data vendor processes and integrates real-time bond trading data generated in the course of voice brokerage in China between April 2013 and March 2023. As a result, Sumscope was also the only company in China that can provide relevant data services for real-time trading of voice brokerage in the downstream market.

The Shanghai AMR found that Sumscope had refused to sell its exclusive data to downstream companies willing to buy the data without justifiable reasons and set minimum transaction amounts while providing the data services. The Shanghai AMR concluded that Sumscope had abused its dominant position by refusing to deal and imposing unreasonable transaction conditions, which undermined the rights and interests of other financial information service providers, bond trading organisations and investors, and hindered the continued innovative development of the relevant data services market.

The case was the first penalty case in the field of financial data concluded by China’s antitrust enforcement agencies. Data is becoming a core resource for corporate competition, and the monopolistic behaviour related to the data area not only distorts the market, but also stifles innovation and fairness. This case sets an important precedent for antitrust enforcement within the financial data sector. The enforcement agencies’ analytical approach to defining relevant markets and evaluating competitive harm reflects a profound understanding of the unique nature of data and the dynamics of the financial market.

(2)Weihai Water Group Co Ltd

The SAMR published a penalty decision on 29 November 2024, fining Weihai Water Group Co Ltd (Weihai Water) 65.21 million yuan,[13] amounting to 3 per cent of Weihai Water’s annual turnover in 2022, which is also the highest antitrust penalty in 2024, accounting for nearly half of the amount forfeited for the year.

Weihai Water has a dominant market position as the sole urban public tap water supplier in Weihai, a city in Shandong province. The Shandong AMR found that Weihai Water abused its dominant position by restricting property developers’ choice of designers and construction of water supply and drainage facilities in new residential communities. Weihai Water established a comprehensive internal reporting process that required property developers to rely solely on its services for design and construction needs. This system left property developers with no opportunity to engage independent design and construction firms, thus constituting a tied transaction. Additionally, Weihai Water also overcharged users for additional construction costs.

Prior to this administrative penalty, Weihai Water faced a legal action brought by a real estate developer for alleged restrictive trading practice. In June 2022, the Supreme People’s Court of China ruled that Weihai Water restricted the options for design and construction providers for new projects by providing only the contact information of its subsidiaries in the Water Supply Service Guide, which is publicly available on the local government’s website. As a result, property developers were either unaware that they could choose other providers for design and construction services, or they were concerned that opting for service providers other than Weihai Water’s subsidiaries would negatively impact the construction of their water supply projects. This practice was deemed a hidden form of abusing the dominant position. In May 2023, the Shandong AMR received a complaint and initiated an administrative investigation into Weihai Water for similar monopolistic behaviour. This case highlights the increasing alignment between antitrust enforcement and the judiciary. Judicial decisions offer clear legal guidance for administrative actions, while administrative investigations allow for a more agile response to monopolistic practices in the market. These elements work together to establish a comprehensive antitrust governance system.

2.Antitrust: trends, developments and strategies

In 2024, the enforcement of laws against the abuse of dominance continued to focus heavily on the livelihood sector, particularly on operators in public utilities such as water, electricity and gas supply. Companies with significant market shares, especially in utilities, should be particularly vigilant about imposing unfair restrictions or unreasonable conditions on transactions.

While no cases of vertical restraint were published in 2024, we understand this does not signify a relaxation of regulatory oversight by enforcement agencies. A noteworthy development was the issuance of a reminder letter by the SAMR regarding competition issues, specifically highlighting unreasonable restrictions imposed on downstream dealers by five automobile suppliers. This indicates that the SAMR is enhancing its supervision of vertical restraints using more flexible and preventive measures. Moreover, the introduction of the safe harbour rule and the flexibility in determining vertical restraint under the new AML may have led to a reduction in the number of vertical monopoly cases. As a result, enforcement agencies will need to spend more time making case-by-case judgements on the competitive effects of such agreements. In particular, the specific market share criterion for the use of the safe harbour rule is still uncertain. Undertakings are advised to remain cautious about adopting the retail price maintenance clause in their commercial arrangements and continue to monitor the development of the relevant implementation rules.

3.Antitrust: outlook

We understand that enforcement agencies will continue their previous trend of concentrating on key areas that impact people’s daily lives, such as pharmaceuticals, public utilities, building materials and consumer products and will particularly focus on issues such as the abuse of market dominance, which often manifests as unfairly high prices and restricted trading practices. Moreover, the SAMR will maintain oversight of emerging monopolistic trends within sectors such as the digital economy, the labour market and technological innovation, all of which are garnering significant global attention. The SAMR expressed explicit concerns about destructive vertical competition within the digital economy, especially regarding the challenges faced by small and medium-sized businesses that are often pushed out by larger firms leveraging their advantages in capital, technology and scale.

Additionally, the push towards a soft supervision system and the introduction of various antitrust compliance incentives signal a shift towards more standardised and refined practices in enforcement. Enforcement agencies are expanding their focus from solely imposing penalties to also implementing preventive measures and providing regulatory guidance. Moving forward, we believe that antitrust agencies will increasingly emphasise guiding businesses to comply with regulations through reminders, encouragement and other flexible methods, rather than solely relying on administrative investigations and penalties. Therefore, we recommend that companies enhance their compliance systems and improve their compliance management practices by implementing internal review mechanisms, providing robust staff training and conducting regular self-assessments. These steps will be crucial for adapting to the growing stringency and normalcy of the antitrust regulatory landscape.

On 25 December 2024, the Standing Committee of the National People’s Congress published the revised draft of the Anti-Unfair Competition Law after its first review for public consultation. The updated draft includes a new provision stating that large enterprises must not abuse their superior position to disrupt fair competition, such as imposing clearly unreasonable payment terms, and forcing their counterparties to enter into exclusive agreements. This newly proposed provision would have an unprecedented impact on the operations of large companies. According to this provision, large enterprises that are not identified as having a dominant position under the AML, might be caught by the proposed Anti-Unfair Competition Law and specifically their particular business practice could be deemed as an abuse of their superior role and subject to penalties for unfair competition. The abuse of superior position provision has raised wider concerns and discussions, and we recommend that enterprises closely monitor the amendments to the Anti-Unfair Competition Law and be well prepared for potential changes in this regard.

V、Merger review

The Provisions of the State Council on Thresholds for Prior Notification of Concentration of Undertakings were revised in January 2024. The relevant turnover thresholds have been raised significantly compared to the previous thresholds.

The new Thresholds for the merger reviews reduced compliance costs of M&A transactions for small and medium-sized enterprises. Furthermore, it enables enforcement agencies to better allocate their limited resources towards the merger review of larger-scale M&As. According to data published by the SAMR,[14] there has been a 17.4 per cent decrease in the number of merger reviews after the implementation of the new Thresholds.

In 2024, the SAMR completed a total of 643 merger review cases. This is a 19.32 per cent decrease from 797 in 2023 due to the new Thresholds. Among these, one case was conditionally approved, 19 were withdrawn by the filing parties after acceptance and the remaining cases were unconditionally approved. Notably, approximately 90 per cent of the merger reviews were cleared at the preliminary examination stage, namely within 30 days of acceptance.

In 2024, out of the completed merger reviews, about 91 per cent were classified as simple filings. Among these simple filings, 56.9 per cent were concluded by five provincial AMRs authorised by SAMR, thereby reducing the workload for the SAMR. On average, the SAMR took about 26.2 days to conclude all merger review cases, while the average review period for simpler filings was just 17.3 days. Local AMRs concluded simpler cases in approximately 16.5 days.

It is important to highlight that on 9 December 2024, the SAMR launched an investigation into Nvidia for suspected failure to fulfil its commitments made under the conditional approval decision of its 2020 acquisition of Melox. This marks the first investigation into a conditional approved case since the new AML took effect.

1.Merger review: significant cases

Non-filing penalties

(1)Highly and Haier case

On 7 June 2024, the SAMR announced that it had imposed a total fine of 3 million yuan on Shanghai Highly (Group) Co Ltd (Highly) and Qingdao Haier Air Conditioner General Co Ltd (Haier) for establishing a joint venture, Zhengzhou Highly (the JV), without filing for merger review in accordance with the AML.[15] This marks the first non-filing case published after the new AML took effect on 1 August 2022, following a gap of nearly two years.

In this case, Highly and Haier jointly invested in the formation of the JV, holding 51 per cent and 49 per cent of the equity respectively. The JV was not approved by the SAMR before the JV’s registration and establishment, constituting an unlawful concentration of operators that was not declared as required by the AML. Since the transaction was unlikely to exclude or limit market competition, and given that both Highly and Haier were subject to mitigating factors, such as being first-time offenders of merger filing, actively cooperated with the investigation and established an effective antitrust compliance system, both companies were fined 1.5 million yuan.

While the penalty of 1.5 million yuan is relatively low compared to the maximum fine of 5 million yuan for each violator under the new AML, the penalty is still three times higher than the previous maximum fine of 500,000 yuan before the amendment of the AML. In this instance, the fact that both companies had ‘established and effectively implemented a well-developed antitrust compliance system’ was considered a mitigating factor. This also demonstrates the application of compliance incentives outlined in the Antitrust Compliance Guidelines for Business Operators.

(2)Maoming Urban Construction’s acquisition of Zhongyuan

On 13 September 2024, the SAMR announced its decision to impose penalties on Maoming Urban Construction Investment Group Co Ltd (Maoming Urban Construction) for acquiring shares of Guangdong Zhongyuan Investment Co (Zhongyuan) without obtaining merger review clearance in accordance with the AML.[16] In this case, Maoming Urban Construction had submitted a merger filing but engaged in ‘gun-jumping’ by completing the registration change of Zhongyuan’s shareholding during the publicity stage of the merger review. As a result, Maoming Urban Construction was fined 1.75 million yuan, marking the highest penalty issued by enforcement agencies in 2024 for a single operator in non-filing cases.

Operators should remain vigilant against the risk of ‘gun-jumping’ before obtaining approval from the SAMR. In practice, some companies rush to integrate their business with the target company during the publicity period, engage in joint marketing promotions or even deploy their management teams. Such actions may be deemed unlawful and qualify as ‘gun-jumping’, exposing the company to severe penalties.

(3)LONGi Hydrogen and Hopewind Electric case

On 30 September 2024, the SAMR announced that it fined Xi’an LONGi Hydrogen Energy Technology Co, Ltd and Shenzhen Hopewind Electric Co Ltd a total of 1.4 million yuan for forming a joint venture on 28 July 2023 without obtaining the merger review clearance.[17]

On 8 October 2023, both parties voluntarily submitted filing documents to the SAMR, acknowledging their failure to file before the closing of the transaction. Given this voluntary disclosure, along with the fact that neither party had a prior non-filing record and both had implemented an effective antitrust compliance system, the SAMR ultimately decided to fine each company 700,000 yuan. This penalty is relatively low compared to two other non-filing cases in 2024.

This case illustrates that having a robust antitrust compliance system can serve as an important defence for companies seeking to reduce penalties during enforcement investigations.

Conditionally approved cases

In 2024, only one case was conditionally approved, far fewer than the five in 2023 and five in 2022. The semiconductor industry is an area of strategic development for China, and major M&A transactions in this area typically attract significant antitrust scrutiny. In the semiconductor industry, China’s antitrust enforcement authorities have conditionally approved 14 cases in total from 2016 to 2024, accounting for as much as 38 per cent of the conditionally approved cases (37 in total) during the same period.

(1)JX Advanced Metals acquisition of Tatsuta

The SAMR conditionally approved the acquisition of Tatsuta Electric Wire and Cable Co Ltd (Tatsuta) by JX Advanced Metals Corporation (JX Advanced Metals) on 11 June 2024.[18] Both JX Advanced Metals and Tatsuta are Japanese companies engaged in the manufacturing and sales of electronic materials. The transaction involves the market for components related to flexible printed circuits (FPC), a crucial material for semiconductors. The SAMR raised concerns about potential bundling between JX Advanced Metals’ blackened surface-treated rolled copper foils, stainless steel reinforcing plates for FPC and Tatsuta’s electromagnetic shielding films and isotropic conductive adhesives, which have adjacent business relationships. As a consequence, the SAMR determined that the proposed deal may eliminate or restrict competition in both the global and Chinese markets for four types of components related to the transaction.

To address these concerns, the SAMR imposed various behavioural commitments on the parties involved. For instance, the parties must not, without justifiable reasons, tie the sale of JX Advanced Metals’ products to Tatsuta’s products or impose unreasonable trading conditions. Additionally, they are required to provide services and products on fair, reasonable, and non-discriminatory (FRAND) terms and ensure that the level of interoperability between relevant products and third-party complementary products is no less than the interoperability level between their own products after completing the transaction.

This case is the only conditionally approved case in 2024, taking a total of 474 days from acceptance to the publication of the decision. With the introduction of the stop-the-clock clause in the new AML, instead of following the previous tradition of parties withdrawing and resubmitting their notification before expiry of the period, this case has applied the clause, with a stop-the-clock period of nearly 11 months, which accounts for the longest stop-the-clock period since the introduction of the new AML.

(2)Investigation on Nvidia’s non-compliance regarding its acquisition of Melox

On 9 December 2024, the SAMR opened an investigation against Nvidia for breaching its remedy commitments under the conditional approval rendered by SAMR for its acquisition of Melox in 2020.[19]

In the 2020 remedy decision, the SAMR concluded that the acquisition would have a significant impact on relevant markets and could harm competition. Nvidia offered a set of commitments to solve the competition concerns of SAMR. Based on these commitments, the SAMR conditionally approved the transaction accordingly. In particular, Nvidia must continue supplying relevant graphics processing unit (GPU) accelerators, high-speed network interconnection devices and related software products to the Chinese market under FRAND terms after the acquisition. Since the investigation is just beginning, it still not yet clear which specific commitments Nvidia may have violated. However, reports suggest that since 2022, Nvidia has often stopped supplying GPU products to China, which would be a serious breach of those commitments and thus triggered the investigation.

This case might be related to the recent US trade restrictions on technology exports to China, which could have pressured Nvidia to halt certain GPU supplies. Nvidia might claim it should be exempt from penalties due to a lack of intent to violate China’s antitrust laws or due to restrictions imposed by US law. However, it is doubtful that the SAMR would accept this argument. It remains to be seen whether Nvidia will take the initiative to propose a solution and how the SAMR will assess and address Nvidia’s conduct.

2.Merger review: trends, developments and strategies

With the new filing turnover thresholds in place, the SAMR is taking an even more stringent and prudent review of merger filing cases due to the overall reduced caseload. Also, the supervision and investigation of non-filing cases are returning to normal, and we expect stricter enforcement measures going forward.

The SAMR strengthened the prior supervision of merger cases through ‘flexible’ enforcement, and improved the antitrust compliance risk alert mechanism for merger reviews. In 2024, the SAMR required at least two ‘killer acquisitions’ that do not meet the filing criteria but may have potential competition concerns to submit to filing. This demonstrated SAMR’s forward-looking and preventive regulatory strategy, enhancing the capacity to identify and address potential antitrust behaviour.

The penalties for non-filing cases are expected to be increased significantly under the regime of the new AML and, therefore, notifying parties should be extra aware of the potential legal risks of merger filing in cases where either the turnover standards have been reached, or the standards have not been reached but there may be the effect of excluding or restricting competition.

3.Merger review: outlook

In August 2024, the SAMR released the Guidelines for Discretionary Standards in Imposing Penalties for Illegal Implementation of Concentration of Undertakings (Discretionary Standards) for public comment. The Discretionary Standards clarify the basis, steps, orders, circumstances and factors to consider when determining administrative penalties for non-filing cases. We expect that the introduction of the Discretionary Standards will be finalised in early 2025 and it will result in a more transparent and predictable process for imposing fines on non-filing undertakings in 2025, encouraging companies to manage their behaviour proactively to reduce potential penalties. Companies should carefully consider the compliance incentives detailed in the Antitrust Compliance Guidelines for Business Operators and establish well-developed compliance management systems.

Despite recent challenges and rising geopolitical tensions, the author believes that most deals in the high-tech sector, including those in the semiconductor industry, will be able to obtain clearance from the SAMR if handled properly. The notifying parties would need to coordinate their filing strategies in various ways and carefully submit remedies (if necessary) based on the effect on the Chinese market. They should also proactively communicate with law enforcement agencies in a timely way to resolve the SAMR’s competition concerns.

The overall reduction in the number of filings and the redistribution of some review responsibilities to local AMRs will enable the SAMR to focus its assessments on critical areas such as the new economy and high technology, including issues related to killer acquisitions in the internet sector and R&D projects for innovative medicines. Even if the threshold turnover of the companies involved in these transactions does not meet the filing threshold, there is still a possibility of exclusionary or restrictive competition issues arising. Therefore, operators in these sectors must remain vigilant regarding the compliance risks associated with merger reviews to ensure the legality and compliance of their transactions.

In addition, the non-filing cases announced in 2024 were all implemented after the new AML came into force on 1 August 2022, but it is unclear whether non-filing actions implemented before the new AML will still be punished in accordance with the high penalties of the new law. Therefore, further observation of the enforcement trend is still required.

Recently, the SAMR has strengthened its supervision and enforcement by introducing an online alert system to monitor compliance with conditional cases. Companies must rigorously uphold their commitments and establish internal compliance systems. Once the company finds any external factors, such as government policies and change of international market, that hinder its ability to meet its obligations, the company must promptly inform regulators and seek a possible solution to avoid antitrust penalties.

VI、Outlook and conclusions

The introduction of the new AML and accompanying regulations is paving the way for a more robust and professional antitrust enforcement framework in China. In 2025, the SAMR is expected to maintain a steady approach to market competition regulation while intensifying its enforcement in key sectors that significantly impact people’s livelihoods, including pharmaceuticals, consumer products, education and public utilities. Moreover, in 2025, the SAMR is expected to focus on regulating monopolistic behaviours in high-tech industries, including AI and data matters. For instance, an investigation into Google that began in early 2025 underscores that the SAMR is actively observing the regulatory strategies of the EU and other foreign antitrust authorities. This reflects SAMR’s efforts to bolster its oversight and enforcement measures targeting monopolistic practices by multinational tech corporations.

Furthermore, with the ongoing expansion of antitrust enforcement tools, such as the letter-and-notification system, the SAMR is expected to utilise a comprehensive range of strategies to regulate monopolistic behaviours proactively and monitor potential monopolistic risks more closely. This evolution raises expectations for companies to address antitrust issues promptly while simultaneously providing greater opportunities to manage and mitigate potential risks.

Between 2024 and early 2025, the SAMR has initiated investigations into Google and has been monitoring the potential monopoly risks posed by Avanci’s patent pools. These actions highlight the growing effectiveness of the extraterritorial jurisdiction of China’s AML, indicating that foreign companies must closely observe China’s antitrust law and related regulations, especially concerning cross-border mergers and acquisitions, data monopolies, misuse of intellectual property rights and other abusive behaviours in high-tech industries.

【Footnotes】

[1] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/jzzcxds/art/2023/art_515052484fd94fb1a2d8a648615b4c1c.html.

[2] Original Chinese version available on the website: http://www.legaldaily.com.cn/index/content/2024-12/27/content_9108399.html.

[3] Original Chinese version available on the SAMR website:https://www.gov.cn/zhengce/zhengceku/202401/content_6928388.htm .

[4] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/fldzfes/art/2024/art_1cc891138e754c1c97a6ede98341bcfd.html.

[5] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/fldzfes/art/2024/art_635d601b816e412e88265f83d4f6794d.html.

[6] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/xwxcs/art/2024/art_d750c6a6b8634caeacede92147c715c1.html.

[7] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/fldzfys/art/2024/art_77e07edb4b7f4b72844a37c9add3e9fe.html.

[8] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/jzzcxds/art/2024/art_2d4b1705febf41c38856dda554e84857.html.

[9] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/zw/zfxxgk/fdzdgknr/fldzfys/art/2025/art_4f615267290d443f9b4e571774ed3d2a.html.

[10] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldys/tzgg/xzcf/art/2024/art_8b48d4cc830b4b08b76b90122cd035c9.html.

[11] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldys/tzgg/xzcf/art/2024/art_c096431514684cefb2e1deb42a67330f.html.

[12] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldys/tzgg/xzcf/art/2024/art_49c68fbfff734887a6033eb51c15d417.html.

[13] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldys/tzgg/xzcf/art/2024/art_da13d8e9969c467995270a6f53c39345.html.

[14] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldes/sjdt/gzdt/art/2024/art_01fe5dd00f714b89ad1c837324f0ba0e.html.

[15] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldes/tzgg/xzcf/art/2024/art_9654125c3d2d44c6be54c41da17f7372.html.

[16] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldes/tzgg/xzcf/art/2024/art_54b79e825dcc45b58d8a2caf5aa13ba5.html.

[17] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldes/tzgg/xzcf/art/2024/art_44b4edbd01124ef28b2ab68c2793df9d.html.

[18 Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldys/tzgg/ftj/art/2024/art_0df7c86f73f44c06b20e64f79950df5c.html.

[19] Original Chinese version available on the SAMR website: https://www.samr.gov.cn/fldes/sjdt/gzdt/art/2024/art_5d9c11763cd147febf930c90ffd4b4d2.html.

本文原載於Lexology《Public Competition Enforcement》第17版

本文原載於Lexology《Public Competition Enforcement》第17版

標題:Annual Review of China’s Anti-Monopoly Law Enforcement (2024)

聲明: 本文版權屬原作者。轉載內容僅供資訊傳遞,不涉及任何投資建議。如有侵權,請立即告知,我們將儘速處理。感謝您的理解。